Protecting our community for 175 Years

Environmental, Retail Theft & Fraud Division

The Environmental, Retail Theft, and Fraud Division of the San Joaquin County District Attorney's Office was established to consolidate in one division the different units involved in the prosecution of crimes that affect San Joaquin County as a community. Each of these units deals with a class of crime that affects the right of each member of the community to live with dignity and integrity, whether directly, as a victim, or indirectly, as a result of the occurrence of the crime. These units work with county and state agencies to ensure businesses and individuals comply with the rules and regulations of City Ordinances, San Joaquin County Codes, and California State Statutes. Its focus is the effective prosecution of those who violate laws that protect and promote the quality of life of the residents of San Joaquin County. It is also dedicated to making sure that the victims of these crimes are remembered by the criminal justice system.

The purpose of each unit is to serve as a constant reminder of the importance of bringing violators to justice and for the preservation of our community's way of life. Great emphasis is placed on educating the public on how to protect themselves from being a victim through its community outreach and educational programs.

Case Information

For specific case information call

(209) 468-2400

Units

- Auto Insurance Fraud Unit

- Auto Theft Task Force

- Consumer Fraud Unit

- EDD Fraud Prevention Unit

- Environmental Protection Unit

- Identity Theft Unit

- Real Estate Fraud Unit

- Retail Theft Unit

- Workers' Compensation Fraud Unit

Auto Insurance Fraud Unit

Auto insurance fraud causes economic loss and distress to our community. It causes premiums paid by members of the public to be unduly taxed to offset the fraud that occurs. It may even endanger the lives of unsuspecting victims in staged auto collisions performed to file fraudulent insurance claims.

Independent research in Auto Insurance Fraud estimates that one-third (1/3) of all bodily injury claims for auto accidents contain some fraud including, but not limited to, the exaggeration of injuries or vehicle damage. Participants in auto insurance fraud may include auto body shops, lawyers, doctors, chiropractors, and other medical care providers who bill for services they did not perform. Perpetrators of auto insurance fraud can range from individuals to sophisticated insurance fraud rings.

To protect the public from this economic loss and distress, the San Joaquin County District Attorney’s Auto Fraud Unit will investigate, arrest, and prosecute those who commit auto insurance fraud, as well as seek to prevent the occurrence of insurance fraud through anti-fraud outreach and training to the public.

Auto Theft Task Force

In the summer of 1998, the California Highway Patrol, San Joaquin Sheriff's Department, local Chiefs of Police, and the District Attorney met to address the increase of auto theft in San Joaquin County. They formed a county-wide task force to investigate auto theft and called it Delta R.A.T.T. (Delta Regional Auto Theft Team). The team currently consists of members from the CHP, Stockton PD, Sheriff's Department, Manteca PD, Tracy PD, San Joaquin County Probation Department, and the San Joaquin County District Attorney's Office.

If you see suspicious activity, contact your local police department or Delta R.A.T.T. at (209) 948-3790.

Consumer Fraud Unit

Consumer fraud refers to deceptive or dishonest practices employed by individuals or companies to exploit consumers for financial gain. It involves any act of deception or misrepresentation that leads consumers to make purchases, provide personal information, or engage in transactions under false pretenses. Consumer fraud can occur in various forms, such as online scams, identity theft, telemarketing fraud, pyramid schemes, false advertising, and fake product sales.

The primary goal of consumer fraud is to deceive consumers into believing they are getting a legitimate product or service, while in reality, they are being tricked or defrauded. Fraudsters may use various tactics, including false claims, hidden fees, bait-and-switch techniques, phishing emails, fake websites, or impersonation, to gain the trust of unsuspecting individuals.

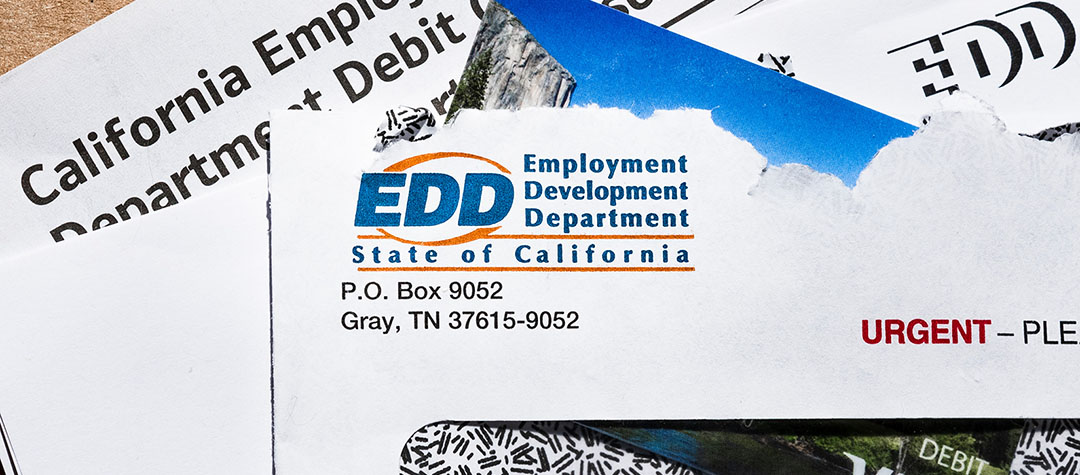

EDD Fraud Prevention Unit

EDD fraud refers to fraudulent activities associated with the Employment Development Department (EDD), particularly involving unemployment benefits. EDD fraud has become a significant issue, especially during times of economic hardship or crises, like the COVID-19 pandemic, when the volume of unemployment claims increases dramatically. EDD fraud poses a serious challenge to unemployment systems, but through a combination of technology, vigilance, and legal action, it can be mitigated.

Environmental Protection Unit

The Environmental Protection Unit of the San Joaquin County District Attorney’s Office serves to protect our county’s natural resources, as well as the health and safety of San Joaquin County residents through the investigation and prosecution, both civilly and criminally, of a wide variety of violations of environmental laws. These laws are designed to protect San Joaquin County residents, as well as the air, water, land, and wildlife.

Enforcement of these environmental laws and regulations also serves to prevent violators from gaining an unfair business advantage over competitors who adhere to the rules. Dedicated to protecting natural resources, and preventing air and water pollution, the Environmental Protection Unit investigates and prosecutes complex environmental crimes including violations of laws involving the handling, storage, transportation, and disposal of hazardous waste, underground storage tanks, hazardous material laws, and regulations.

Identity Theft Unit

Identity theft can happen to ANYONE. It is a serious crime. It can disrupt your finances, credit history, and your reputation. It can result in financial losses and take time and money to resolve. Identity theft happens when someone steals your personal information and uses it without your permission. When the crooks have your personal information they can create credit cards and identification cards with your information to make large purchases or finance automobiles, without you even knowing what they are doing. Identity thieves may get your information by stealing your mail, purse, or wallet, going through your garbage, or stealing your sensitive information from a place you do business with. Identity thieves may also call you on the telephone posing as an official such as an IRS agent and try to get you to provide personal information, or by hacking into your computer.

Real Estate Fraud Unit

Real estate fraud involves illegal activities that use deception, misrepresentation, or deceit to gain an unfair advantage in real estate transactions. This can include actions such as property flipping using false appraisals, mortgage fraud, title fraud, foreclosure fraud, rental fraud, and other fraudulent schemes. These activities are perpetrated by individuals or groups intending to profit at the expense of others, often exploiting vulnerabilities in the real estate market and legal system.

Real estate fraud is a significant issue that affects individuals and communities, leading to financial losses, instability, and a loss of trust in the real estate market. The District Attorney's Office addresses this problem with a multifaceted approach involving education and collaborative efforts to detect and prevent fraudulent activities.

Retail Theft Unit

Retail theft, also known as shoplifting, is a criminal act that involves the stealing or attempted stealing of merchandise from a retail establishment. In California, retail theft is typically charged as either petty theft or grand theft, depending on the value of the goods stolen. Petty theft is committed when the value of the stolen goods is $950 or less, while grand theft occurs when the value exceeds $950.

In both cases, a person convicted of theft can face serious penalties, including imprisonment and fines. Specifically, grand theft can be charged as a misdemeanor or felony, with the latter carrying more severe penalties. A felony conviction could result in a sentence of 16 months, two or three years in jail, a fine of up to $10,000, or both.

Organized Retail Theft (ORT) is a more significant and sophisticated form of retail theft. It involves an organized group of individuals systematically stealing from retail stores, and then often reselling the stolen goods. ORT doesn't usually involve casual or opportunistic shoplifters; it's a form of theft that is carefully planned and executed.

ORT has posed a significant challenge to retailers and law enforcement agencies in San Joaquin County, California, and across the United States. Because of its organized nature, it has a far greater impact than individual instances of shoplifting. It leads to higher retail losses, affects pricing, and can even lead to job losses within the retail industry.

To address this issue, California enacted Assembly Bill 1065 in 2018, which gives law enforcement and prosecutors additional tools to combat ORT. This legislation allows for individuals involved in coordinated theft to be charged with felony conspiracy, even if the value of the stolen goods is less than $950.

Workers' Compensation Fraud Unit

Workers' compensation insurance fraud impacts all residents of San Joaquin County. Fraud may be committed by the employer, in the form of being under-insured or not insured at all. Or, fraud may be perpetrated by the employee who makes a fraudulent claim. Examples of workers' compensation insurance fraud include:

- Claimant Fraud

- Misrepresenting an injury to obtain insurance benefits.

- Premium Fraud

- Misrepresenting payroll to avoid higher insurance costs.

- Provider Fraud

- Relating to medical or legal services provided in a fraudulent claim.

- Uninsured Employer

- Employers that willfully fail to provide workers' compensation insurance.

The cost of workers' compensation insurance fraud affects all of us in the form of higher prices for goods and services. Fraudulent claims also contribute to the high cost of medical care, with overbilling and unnecessary treatments. The San Joaquin County District Attorney's Office aggressively investigates all forms of workers' compensation fraud. Since 2015, the District Attorney has recovered nearly $250,000 in fraudulently obtained workers' compensation benefits. If you suspect workers' compensation insurance fraud, would like more information on the work being done by the District Attorney, or would like someone to speak to your group about this or other topics, please contact (209) 468-8963.